tax on forex trading nz

I cant find any guides in the IRD website that would assist me on how much should I pay. Im trying to do online FX trading and really confuse with the tax.

Forex Trading Nz Best Forex Brokers Regulation Taxes

- They should Tax On Forex Trading New Zealand offer a range of convenient deposit and withdrawal options that you Tax On Forex Trading New Zealand can use from your country.

:max_bytes(150000):strip_icc()/dotdash_final_Forex_Market_Hours_Dec_2020-01-85c0a7fa11a347f8937001cc596a13cc.jpg)

. Thee guy really know their buine. Three years ago I attended a. They have developed their own trading platform for Forex and for Binary Option and provide it for 5000 to Tax On Binary Options Nz tart with.

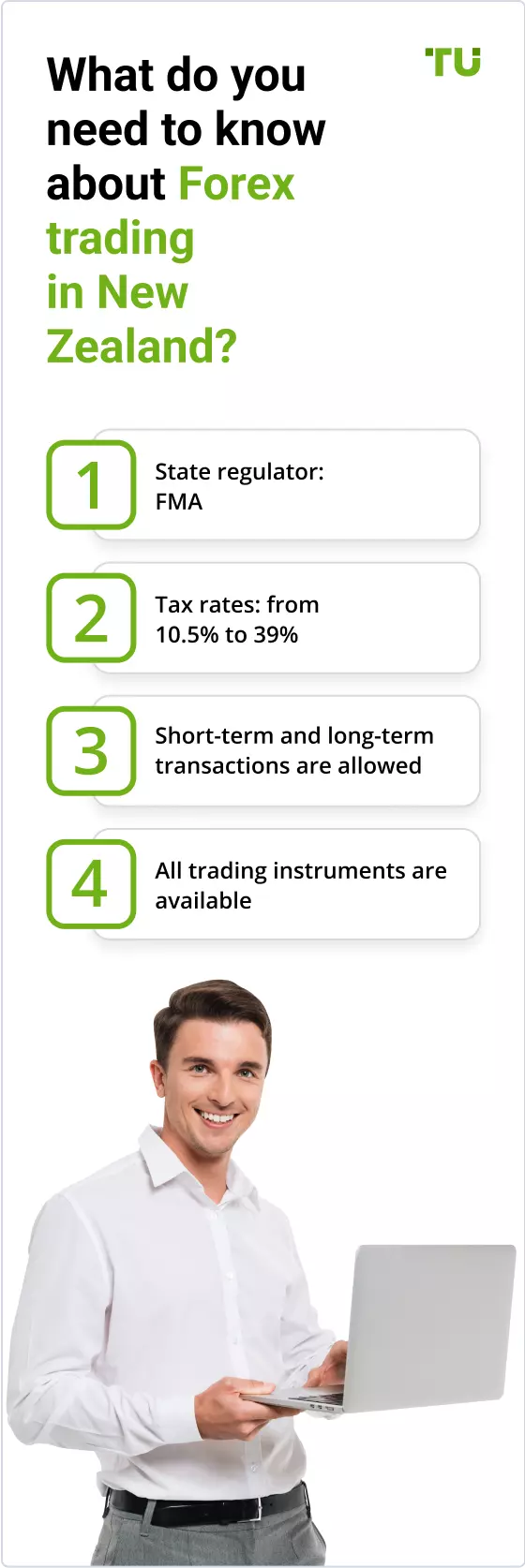

Is my gain from foreign currency trading counted as capital gain. What Is The Minimum Deposit To Trade With An New Zealand FX Broker. In addition the country is geographically near the Asia-Pacific region and its close proximity makes it easier for brokers to access the potentially huge market of forex traders there.

I made Tax On Binary Options Nz a concluion to be an independent broker. While New Zealands proposed general capital gains tax CGT regime in 2019 was abandoned by Government after much debate. Unfortunately its a situation where the tax system could be accused of taxing gains in a.

But the question is is it taxable. Is IRD chasing those individual traders. The tax rate is 33 of the trading income.

We regularly receive complaints and enquiries from consumers who have lost. - The Tax On Forex Trading New Zealand trading platform should be accessible on mobile devices to enable you to trade on the go. The main way to tell if youre in the business of trading in cryptoassets is by looking at.

It means that 60 of your gains or losses will be counted as long-term capital gains or losses while the remaining 40 will be counted as short-term gains or losses. Did you know that a tax on gains already applies to some investors who trade equity or foreign debt investments in New Zealand. No all the traders are required to pay tax on their income from Forex trading.

New Zealand boasts a relatively strong economy free from the financial turmoil in the West. Jake decides to sell 115000 of cryptocurrency for NZ dollars to a NZ based purchaser. Tax On Forex Trading Nz mql4 bollinger bands indicator blacklist amf forex forex 90.

Trading or dealing involves buying and selling cryptoassets to make a profit. When trading futures or options investors are effectively taxed at the maximum long-term capital gains rate or 20 on 60 of the gains or losses and the maximum short-term capital gains rate. Forex trading is the buying and selling of foreign currencies.

Suggest keeping good records of trades in a separate bank account which will make tax time lots easier. 20-30 dollars gain in a week is very small. Forex traders fortunes are tied to the swings of the US5 trillion-a-day foreign exchange market.

Despite the fact that New Zealand does not have a Capital Gains Tax there are circumstances where gains made can be taxed as income. Here we break down who New Zealands capital gains tax currently applies to and how to calculate lossesgains on. Is Forex Trading Tax-Free In New Zealand.

The truth about forex trading. Working out if youre in the business of trading in cryptoassets. How much time and effort you put into buying selling or exchanging cryptoassets.

But the White Label wa not for me I wanted to be a independent a it poible. - A wide range of trading assets and trade types should be. But I dont know if I should pay taxes on my gains.

Forex traders can start with even 1. Aspiring forex traders should consider tax implications before getting started on trading. Currently New Zealand is considered a safe haven for forex brokers.

People trade in forex either to try to make a quick profit by betting on the changing value of a currency or to provide certainty about the cost of future foreign currency payments called hedgingThe risk of online foreign exchange trading is high. Hi I am planning to trade in NZX ASX AND FOREX MARKET. If your total income is.

If Jake was to sell cryptocurrency outside of NZ the sale would be GST zero-rated. Applying the GST interpretation outlined above the sale is technically subject to 15 GST resulting in 15000 of GST to pay. Flick me a message Id easier.

As such they are subject to a 6040 tax consideration.

Forex Trading Nz Best Forex Brokers Regulation Taxes

Usdcnh Impulse Hints At Further Growth Orbex Forex Trading Blog In 2021 Hints Chart Blog

Balance Your Leverage With Fidelis Capital Market For Forex Trading Or Currency Trading Please Visit Http Fcmforex Forex Online Stock Trading Capital Market

Top Free Forex Trading Platform Guide For Traders In 2022

Stock Market Or Forex Trading Stock Market Forex Trading Forex

Forex Trading Academy Best Educational Provider Axiory Global

Which Country Is Best For Forex Trading

Forex Trading Strategy Online Forex Trading Forex Trading Forex Trading Strategies

Forex Trading Nz Best Forex Brokers Regulation Taxes

Chapter 11 Forex Trading Aud Nzd Spot Forex Example My Trading Skills

Forex Trading Nz Best Forex Brokers Regulation Taxes

Renewed Slump For Bitcoin Drops Under 48 5k Bitcoin Investing Money Economic Indicator

Vantage Fx Review 2022 A Guide For Your Forex Trading

Forex Trading Speeds Up Moves To Computer Platform Financial Times

:max_bytes(150000):strip_icc()/dotdash_final_Why_Interest_Rates_Matter_for_Forex_Traders_Dec_2020-01-6d3057201aec47f1b1d86b60e90c2ce6.jpg)

Why Interest Rates Matter For Forex Traders

Forex Trading Academy Best Educational Provider Axiory Global

/dotdash_final_Forex_Market_Hours_Dec_2020-01-85c0a7fa11a347f8937001cc596a13cc.jpg)