loveland co sales tax license

Contacting Larimer County Sales Tax for an address change only. There is a one-time processing fee of 25 which may be paid by cash or check.

Co Dept Of Revenue Co Revenue Twitter

Renewed licenses will be valid for a two-year period that began on January 1 2020.

. For assistance please contact the Sales Tax Office at 303-651-8672 or email SalesTaxLongmontColoradogov. This is the total of state county and city sales tax rates. 35 rows Business Licenses Required at All Levels of Government for Businesses in Loveland Colorado.

However sales tax is also collected for counties cities and special districts. You also can visit the Sales Tax Office in the Longmont. A sales tax license is required in order to collect and remit sales tax that is collected by the Colorado Department of Revenue.

Third Street Utility Billing Front Cashier Loveland CO 80537 Get Directions. Southglenn CO Sales Tax Rate. Adams To Pick Up an Application Loveland CO 80527 Get Directions.

Before you apply for a sales tax license or submit your first payment please contact your bank and provide them with the City of Lovelands ACH DebitAccess ID 8846000609 to ensure your payment will not be rejected. Littleton CO Sales Tax Rate. The County sales tax rate is.

No credit card required. Each physical location must have its own license and pay a 16 renewal fee. Must supply a copy of Drivers License.

This empowers you to discover accurate costs for your Loveland Colorado sales tax permit. Single Special Event License. 4 Town of Berthoud.

The state sales tax rate in Colorado is 29. There is no fee for a new license will be mailed to the business during the time new applications are processed. 500 East Third Street Ste.

110 Loveland CO 80537 Phone. 4 rows The 67 sales tax rate in Loveland consists of 29 Colorado state sales tax 08. Payments may be made by cash check money order or by credit card.

Ad Apply For Your Colorado Sales Tax License. The Loveland sales tax rate is. Longmont CO Sales Tax Rate.

Loveland Clothing Sales License Ie Get a Clothing Sales license in CO 80537 442181. A contractor that worksperforms services in Fort Collins regardless if they live or have a business located in Fort Collins are required to have a Sales. 3 to 7.

Did South Dakota v. In the 1990s when the City of Loveland became a home rule city collection of all sales and use taxes previously the responsibility of the state were taken over by the City of Loveland. This is a two-year license which is free to all standard sales tax license holders.

In 2018 Larimer County voters approved a county-wide one-quarter of one percent 25 county-wide sales tax to. Welcome to Sales Tax. For our sales tax permit compliance solutions enter your city state and industry at LicenseSuite and click Get Your.

Longmont Sales Tax Division 350 Kimbark St Longmont CO 80501. Click on the link below to. Larimer County and State of Colorado sales and use tax rates can be found online or by calling 970-494-9805.

At LicenseSuite we offer affordable Loveland Colorado sales tax permit compliance solutions that include a comprehensive overview of your licensing requirements. Complete in Just 3 Steps. 69 for sales made within Weld County in the Town of Berthoud.

Address City of Loveland 500 E. 4-3-510 Sales Tax Returns are required even when there is no tax due. You can apply for a state tax identification number using the online form CR 100 New Employer Registration.

Weld County currently has no sales tax. All Brick and Mortar Home-Based Businesses and Service-Based Businesses ie. What is the sales tax rate in Colorado.

11th Street Ste 100 Loveland CO 80537 Get Directions. Get Your Sellers Permit for Only 6995. Pueblo West CO Sales Tax Rate.

Loveland CO Sales Tax Rate. Return the completed form in person 8-5 M-F or by mail. Northglenn CO Sales Tax Rate.

Tax License information registration support. Returns for small business Free automated sales tax filing for small businesses for up to 60 days. Per Windsor Municipal Code Sec.

The Colorado Department of Revenues Sales and Use Tax Simplification SUTS Lookup Tool is available to lookup municipality and delivery address sale tax rates. Business may not be conducted until a Business Sales Tax License has been issued. Wayfair Inc affect Colorado.

Pueblo CO Sales Tax Rate. Quickly Apply Online Now. The Colorado sales tax rate is currently.

Inspections May Be Required. For General Business or Retail Sales Tax. Parker CO Sales Tax Rate.

Current 2021 Sales Tax Rates. Register as a new User Apply for a Sales Tax License Renew your License or File your Return Citizen Access Login. The Loveland Use Tax was created in the late 1990s and imposes a 3 fee on all materials used in.

The Windsor sales tax rate is in addition to State of Colorado and Larimer County sales tax. If the licenses is needed immediately a fee of 500 will be charged. Days for processing and approval.

77 for sales made within Larimer County in the Town of Berthoud. Ad New State Sales Tax Registration. Effective January 1 2019 Larimer County sales and use tax has increased to 8.

The sales tax license enables the business to collect sales tax when they resell the items. The Sales Tax License fee is 2000. Security-Widefield CO Sales Tax Rate.

29 State of Colorado8 Larimer County Additional 7 on retail marijuana sales. The minimum combined 2022 sales tax rate for Loveland Colorado is. Address Loveland Public Library 300 N.

For a temporary location other than your regular business location and valid for one event only where there are three or more vendors. Address House of Neighborly Service - The Life Center 1511 E. 20 BUSINESS SALES TAX LICENSE APPLICATION.

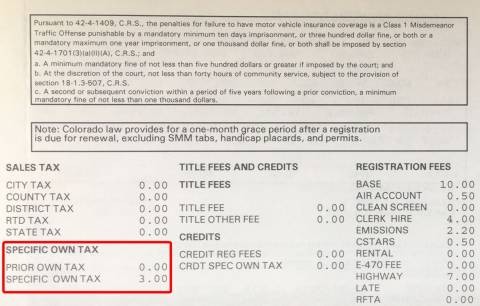

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

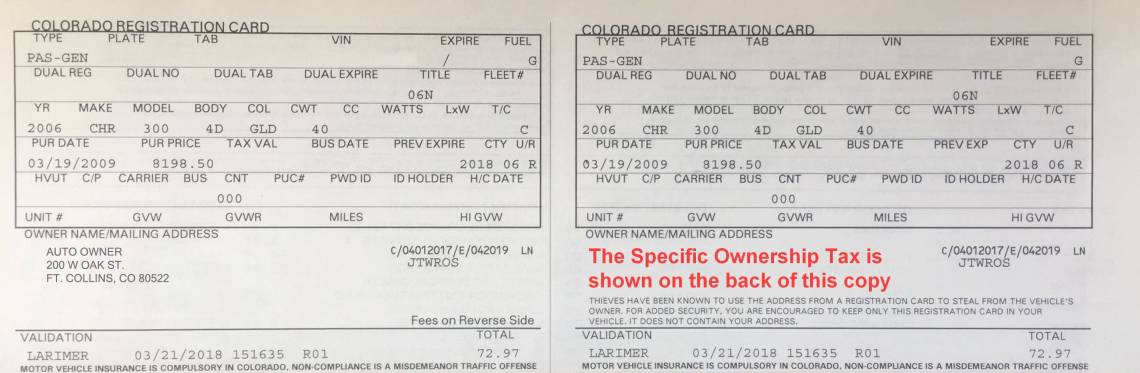

Specific Ownership Tax Larimer County

Specific Ownership Tax Larimer County

Vans Men S Classic Slip On Atcq A Tribe Vans Mens Vans Vans Classic Slip On Sneaker

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Save Now At Fashion Outlets Las Vegas With Coupons And Vip Discounts On Shopping Dining And More Las Vegas Shopping Las Vegas Vegas

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

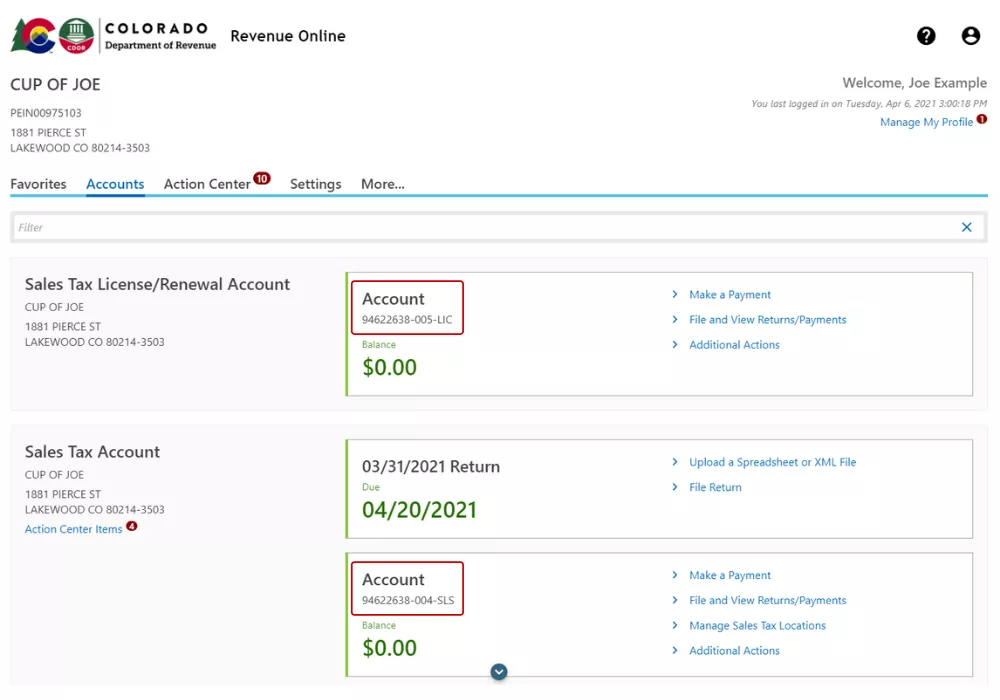

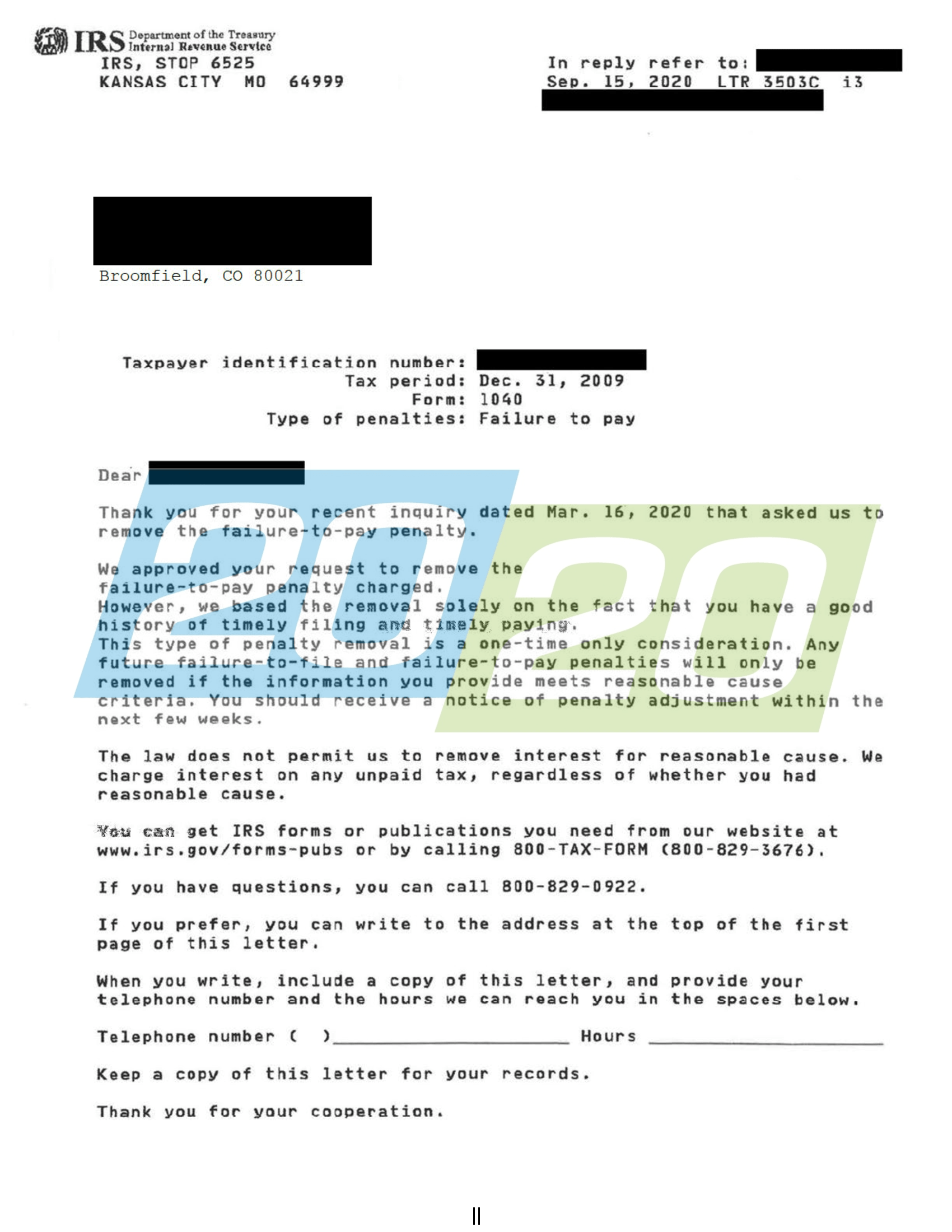

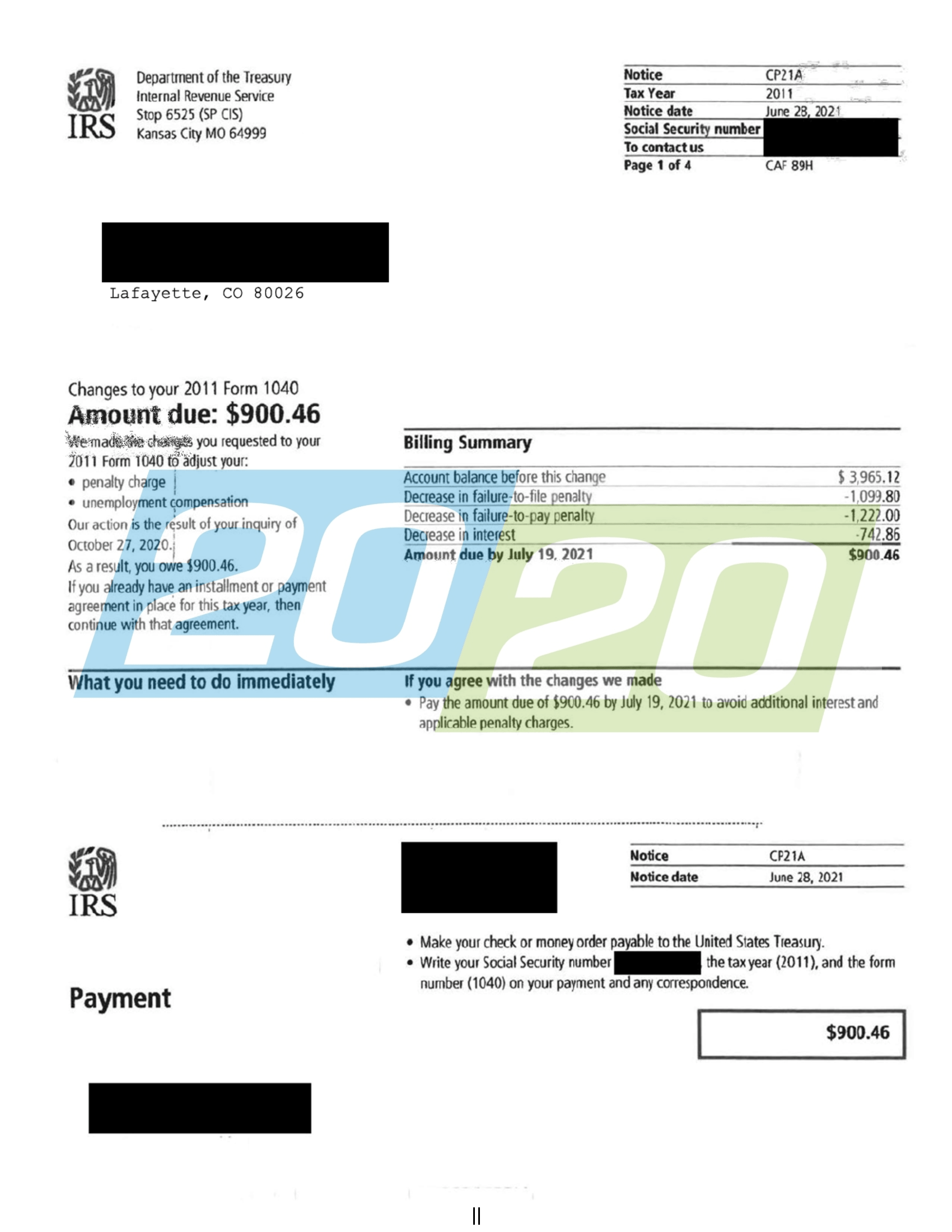

Tax Resolutions In Colorado 20 20 Tax Resolution

Colorado Sales Tax Guide And Calculator 2022 Taxjar

Where To File Sales Taxes For Colorado Home Rule Jurisdictions Taxjar

Tax Resolutions In Colorado 20 20 Tax Resolution

Renew Your Sales Tax License Department Of Revenue Taxation

Register New Businesses In Colorado Colorado Business Express Business State Of Colorado Colorado

Tax Resolutions In Colorado 20 20 Tax Resolution

Larimer County Where Do Your Property Tax Dollars Go

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Business Sales Use Tax License Littleton Co

Pundak De Luxe Jaffa Tel Aviv Cafe Bar Restaurant Decor Restaurant Interior